Managing Multiple Bank Accounts In Xero

An attendee has asked:

“If you’re feeding all the cash deposits from the sales and it goes into your main bank account, and you split off all these different accounts, as far as bookkeeping and all that sort of thing, how does that work with Xero and having all the different accounts, for tax time and all the reconciliations? I might be feeding more money into the BAS account or my expense account, and then have to shift some back. Just keeping track of that whole flow of money, how does that impact, or how do you manage it?”

Here’s our answer-

We’d probably want to work out on how much you should allocate each week in the BAS account. If your quarterly bill is $20K and your quarterly super bill is another $10K, that is $30K over the quarter, divided by the weeks, will give you that answer. With your expense accounts, you can put $5K and when it diminishes, you can top it back up again.

Another method is to work out a rough budget and just transfer that every week. We can go to huge lengths to calculate exactly. It is never going to be perfect, but having a system like this is better than no system.

How do you keep track of it in Xero?

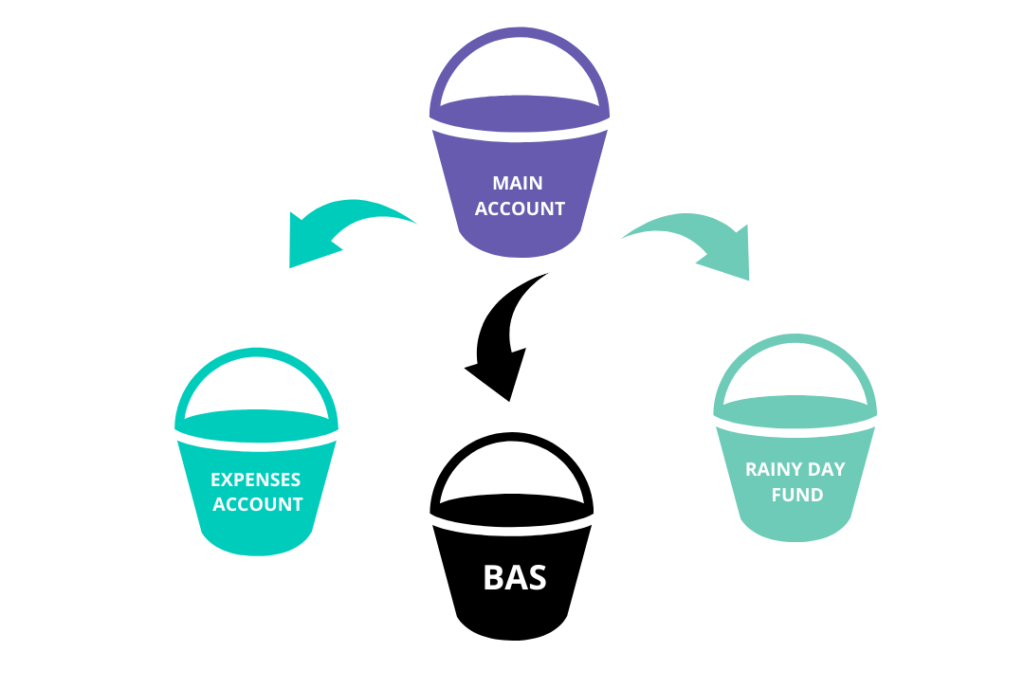

For example, you have four business bank accounts which are your main, your BAS, your expense account and your rainy day fund. The bookkeeper can go in and reconcile transfers between the two accounts. And it is simple as long as they are all feeding into your Xero account. The bookkeeper can all pick up the ins and the outs and as long as you use things like when you’re transferring.

Register to our next event.

Get Cashed Up