Sarah Riegelhuth On Helping Millennials Become Financially Free & How To Manage A Remote Team

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

Is it true that millennials don’t know how to handle money? Millennials are our future leaders, so if they lack financial education, what does that mean for our future? This education gap inspired our guest, Sarah Riegelhuth, to create a community called Wealth Enhancers – a Financial Planning and Advice Company for Gen Y’s and Millennials across Australia.

In today’s episode, I sit down with Sarah, who is a serial entrepreneur and one of Australia’s leading finance experts. She is also the Author of ‘Get Rich Slow: Start Now, Start Small to Achieve Real Wealth.’ Sarah is passionate about personal finance and helping people, truly embodying her company’s purpose of enabling millennials to become financially free.

We kickstart this episode by asking Sarah about her passion for finance and her experience in the industry. She shares that with Wealth Enhancers, they built a community for high achieving millennials who want to be the best they can be. They believe that current and future leaders must have financial stability, so they can achieve their personal goals, live their values, and create a better world.

We also learn how Sarah has built Wealth Enhancers with a fully remote team, and discover the benefits and issues behind this strategy.

We talk about Sarah’s latest project – Wealth Creation for Millennials. It’s a Free 4-week personal finance course that covers everything millennials need to know about money. Tune in to gain insights on how to lead a remote team, financial tips for business owners, and how mindset has played a role in Sarah’s success.

What You Will Discover in This Episode:

- How & why Wealth Enhancers serve the Millennial market.

- How building businesses that give back can create a better world.

- What B Corp is and why it’s important for entrepreneurs to have their certification.

- How Sarah’s trip to Cambodia changed her life.

- How to balance running a profitable business with giving back and doing good.

- How Sarah developed an abundance mindset to get to where she is now.

- A word of advice from Sarah on how to maintain a remote team that can deliver excellent work.

- The strategies Sarah uses to ensure that Wealth Enhancers consistently delight their customers.

Resources:

Wealth Creation for Millennials – Free Course

Connect with Sarah

Sarah’s Website: WWW.SARAHRIEGELHUTH.COM

Are you enjoying the podcast? Listen to the episode here and leave us a review:

iTunes: https://itunes.apple.com/au/podcast/sarah-riegelhuth-on-helping-millennials-become-financially/id1442173853?i=1000424016702&mt=2

Stitcher Radio: https://www.stitcher.com/podcast/inspiring-business-for-good/e/57248322?autoplay=true

Don’t forget to subscribe on iTunes to be notified when new episodes are released.

7 mistakes keeping business owners struggling for cash

It’s always been our mission to help families pull more money, time and happiness from their business…

But if you look at the stats, not a lot of businesses are actually achieving this…

Of the almost 1.9 million small businesses around Australia, 60% either –

- earn less than $200,000 in revenue

- cannot afford a team

- are unprofitable

- or don’t pay themselves a decent salary

Worse still, ¾ took on debt, did so for survival.

In working with thousands of business owners over the last 7 years, we too have seen that the majority struggle for cash at some point during the Entrepreneur Journey.

Perhaps you can relate …

If there has ever been a time that you’ve wondered how you’re gonna make payroll, or pay the next BAS, then your primary job as a business owner is to get Cashed Up.

There are 7 mistakes that business owners make that are keeping them struggling for cash. Avoid them and you’re well on your way to getting Cashed Up.

P.s. Looking forward to seeing you at the Cashed Up book launch at our NEW offices in Fortitude Valley next Tues 24th at 5:30pm.

SAVE $500,000 TAX | Accounting that pays for itself

We are well known for a campaign we ran two years ago called Save $500,000 Tax. It was a bold and audacious target to save our clients half million dollars in tax by proactively implementing cutting edge tax saving strategies.

We didn’t think we’d actually get the $500,000 tax savings but we knew that we had to GO BIG or GO HOME.

We ended up saving our clients a huge $1.2M in tax in 12 short weeks and went on to be name Top 100 Companies in Australia and featured on many platforms including The DENT Podcast, Small Business Big Marketing, The Courier Mail and TEDx, to name a few.

Most importantly since that campaign we’ve now been able to help our clients save a total $2.35M dollars in tax or $18,000 each business which means our service pays for itself 3 – 4 times and our clients tell us they use to reinvest back into growing their businesses and taking their families on holiday.

Tax on Bitcoin and Cryptocurrency

Background of Bitcoin and Cryptocurrency

Tax on Bitcoin and Cryptocurrencies

Bitcoin and cryptocurrency as a Capital Gains Tax Asset

1. Tax for Passive Bitcoin and Cryptocurrency Investors

2. Tax for Active Bitcoin and Cryptocurrency Traders

Using business structures to trade Bitcoin and Cryptocurrencies

- Sole Trader: If you buy and sell bitcoin or cryptocurrencies in your own name, you can be taxed at the highest marginal tax rate of 47% tax.

- Companies: Or if you run your business through a company, you can pay tax at either 27.5% or 30% tax, depending on your turnover.

- Trusts: if you structure it through a trust, you basically distribute profit from that trust to family members, or other entities (like other companies) in your family group.

Record keeping of Bitcoin and Cryptocurrency trading

B1G1 Study Tour to Kenya

Property Development in Kenya

We visited Aberdare Ranges Primary school on Day 2, then we drove up the road to the village which is where most of the children live.

We learned that much of the poverty and displacement was due to political violence in 2007. Due to an election, if you didn’t vote for the right person your house could be burned down and you could even be killed! Crazy stuff – but real. So it caused a lot of families to head out of the towns, and into the rural areas away from the violence.

But what was great to hear is after the political violence broke out, the Kenyan government gave each family around $100 USD to rebuild their lives.

Now there was an extremely entrepreneurial chief who suggested 1,000 families combine their $100 USD, and buy a big block of land.

From memory, this land was around 5 or 6 acres, and they got a town planner in to create roads, and blocks for each of the families to live on.

Each block has enough room for a very small house, but it was this coming together that created a community – that now 10 years on is thriving.

The kids are getting a great education only 20 minutes walk up the road, and this will mean the kids getting jobs, and bringing money back to this community.

The community even has its own medical centre, seeing 80 patients a day. All of this possible with that chief having his entrepreneurial thought process developing the land.

A hand up, rather than a hand out

One of the more well known projects in B1G1 is the ‘Goat Project‘, which we visited on Day 6.

We think it’s about the meal we’re giving; but it’s so much more.

This project is the hardest one for me to talk about, type about, or even think about.

5 x GAME CHANGING TOOLS TO HELP MAKE 2018 YOUR BEST YEAR YET

Happy New Year, Inspire Family.

I want to support your success in 2018 by sharing with you 5 tools that I personally use every single week, that I believe are critical to business and life success in 2018.

- Bucket List – to help you live the good life.

- One Page Business Plan – get everyone on board with your business strategy.

- 2018 Activities Plan – take 8 – 12 weeks a year holiday.

- Business Budget – actually make some money.

- Your Ideal Week – get some work life ‘harmony’ happening.

During this special FB LIVE for the Inspire Family I’ll give you the tools, share with you how I use them and inspire you to ‘fill in the blanks’ on the template versions I’ll provide.

This really has nothing to do with Tax & Accounting. It’s helping you to pull more money, time and happiness from your business.

Cheers

Harvee

Dream Big. Make an Impact. Remember Your Roots.

Watch entire Game Changing Tools webinar here

Download all 5 GAME CHANGING TOOLS here

Bucket List – to help you live the good life (Part 1 of 5)

Watch Part 1 – Bucket List

Download – Bucket List

(Download and customise for your own use)

One Page Business Plan – get everyone on board with your business strategy (Part 2 of 5)

Watch Part 2 – One Page Business Plan

Download – One Page Business Plan

(Download and customise for your own use)

2018 Activities Plan – take 8 – 12 weeks a year holiday (Part 3 of 5)

Watch Part 3 – Activities Plan

Download – Activities Plan

(Download and customise for your own use)

Business Budget – actually make some money

(Part 4 of 5)

Watch Part 4 – Business Budget

Download – Business Budget

(Download and customise for your own use)

Your Ideal Week – get some work life ‘harmony’ happening (Part 5 of 5)

Watch Part 5 – Your Ideal Week

Download – Your Ideal Week

(Download and customise for your own use)

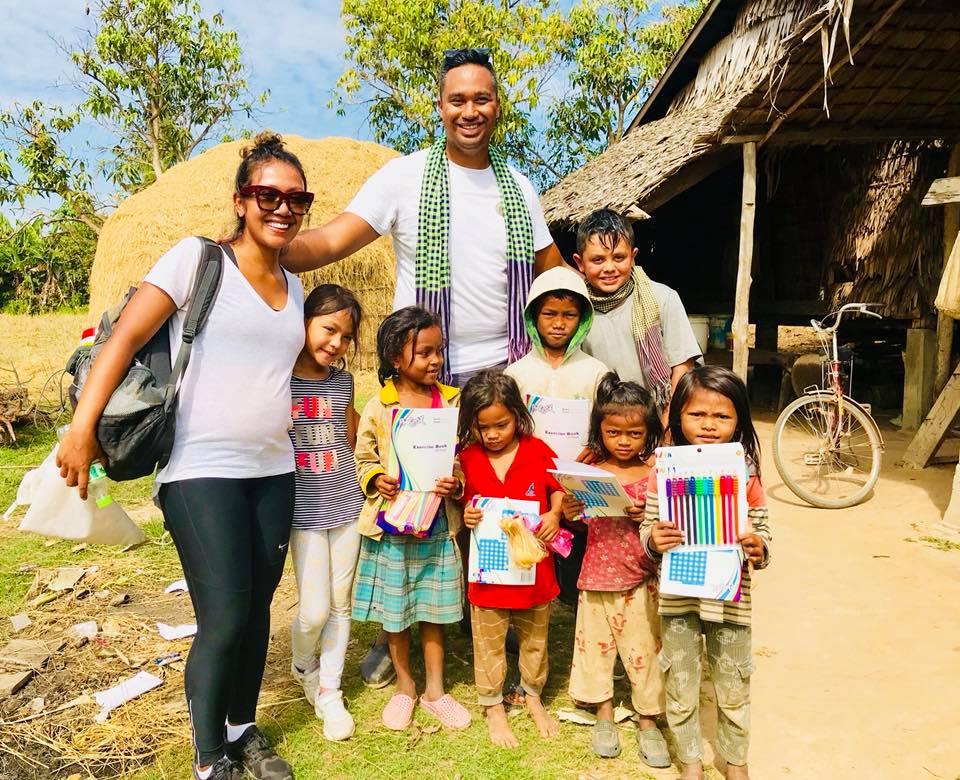

Holiday for Good | Cambodia

“Deep down I reckon every person wants to make a difference. Maybe we’d all like to change something, but how do we do it? How do we tap into the little part of everyone that wants to change the world and do it in a way that’s really simple?”

Daniel Flynn, MD & Co-Founder Thankyou.

I’ve just returned from a life changing family holiday to Cambodia. We went to see first hand some of the impact we’ve been making to families in need. Needless to say, I’ve come back a different person, for the better.

Partnering with the UN’s Global Goals.

We’re a strong advocate for the UN’s Global Goals as a framework to help business owners make a difference in the world by giving back.

Since we started inspire 5 years ago, we’ve partnered with B1G1 Business for Good as a vehicle that makes business giving easy.

Which of the 17 Global Goals resonate with you most?

With B1G1 you can select from 800 carefully screened, high-impact projects that are in line with the Sustainable Development Goals set by global leaders to create a sustainable future for us all.

Saying “NO” to Necker

Nov 2016 I got an invitation to go to Necker Island to meet Sir Richard Branson and spend a week collaborating with other entrepreneurs at the top of their game on how we could us business to make a bigger impact on the planet.

While it was a golden ticket so to speak, it came with a golden price tag too and so we decided to say NO to necker and instead just make a bigger impact.

That’s where the #GIVE1MDAYS campaign was born. A bold an audacious giving target to Give 1,000,000 Days of Life Changing water to families in need in Malawi. We figured the opportunity that is Necker Island would be there for some time, but for the 1.7 million people who are at risk of disease and even death – all for the lack of a bit of clean drinking water – there was really no time to lose.

Giving 3M Days of Help to Families in Need

The beauty of B1G1 as a giving platform is that you decide how your company will give.

Choose the ways to give that fit in best with your way of doing business. Because your membership fee directly funds B1G1’s developments, innovations, and operations, 100% of your giving goes directly to the projects you choose.

For example,

Imagine if every time someone buys a coffee at a cafe, a child is given access to safe clean drinking water.

Imagine if every time someone gets their tax return done at an accounting firm a family in Kenya is given a Goat.

Imagine if every time someone eats a meal at a restaurant, an orphaned child gets a meal.

B1G1 makes this possible and really makes every business a business for good.

So how do we integrate giving into what we do at Inspire?

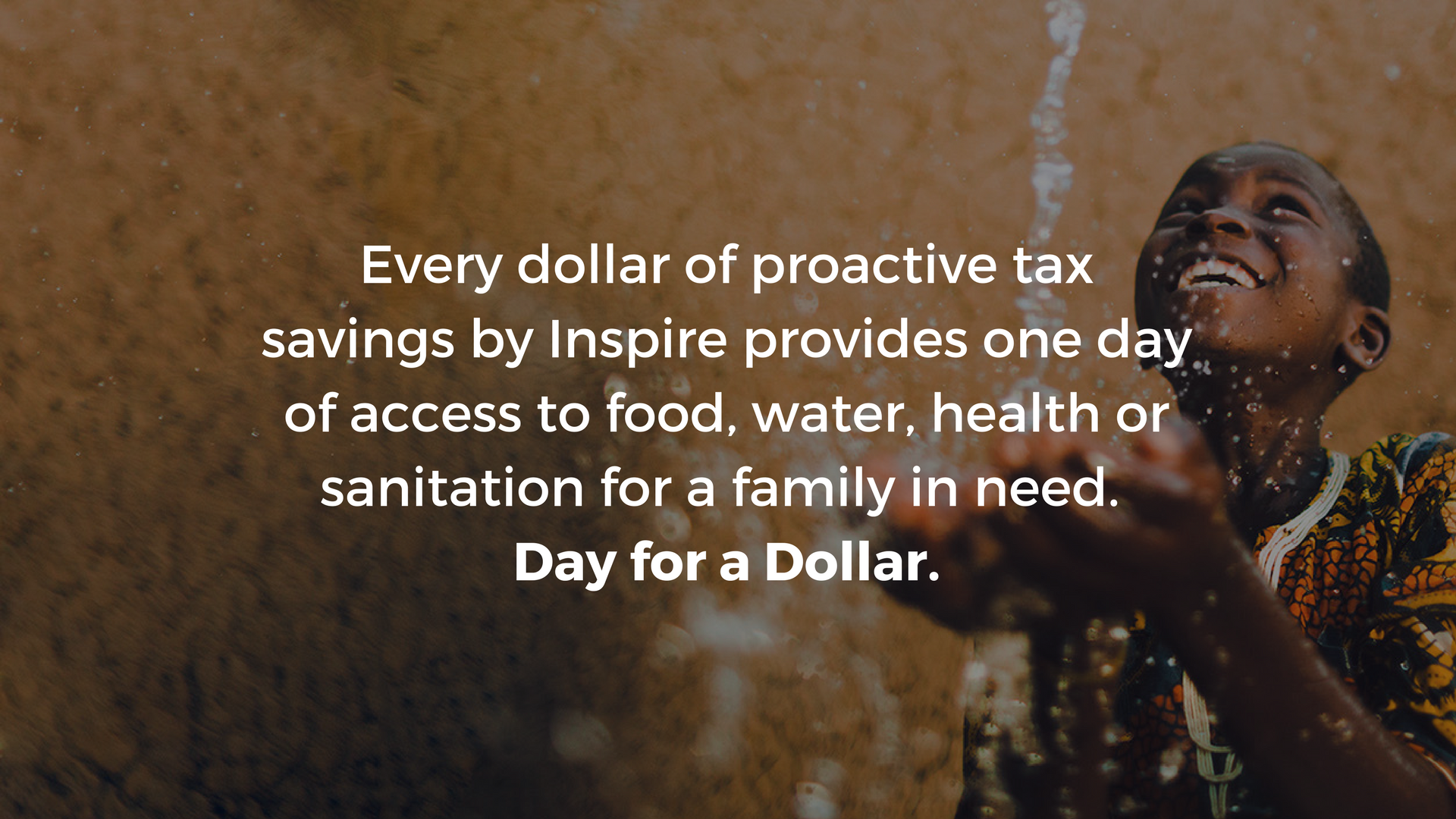

With every dollar of tax we proactively save a small business, Inspire helps a person in need for a day – we call it ‘Day for a Dollar’.

(Inspired by how TOMS One for One initiative gives a pair of shoes for every shoe bought or how Zambrero feeds the hungry through ‘Plate 4 Plate’)

As of Dec 2017, we’ve given 3 Million days of access to food, water, hygiene and sanitation services, thanks to our partnership with global giving initiative B1G1 or Buy One Give One.

Why? As Accountants we love numbers, but when we found out that almost a billion people live on about a dollar a day, we knew we had to do something.

We believe that every business has the power to change lives by integrating giving into its everyday activities.

‘Day for a Dollar’ is a simple but powerful example of how together we can end global poverty, for good.

Caption: WE HIT 3 MILLION $3M in proactive tax savings for small business & 3M days of life changing help to families in need, across 16 countries (when we aimed to #GIVE1MDAYS in 2017).

Becoming a Business for Good.

I believe every business should make an impact, otherwise you shouldn’t be in business. I’m not just talking about building wells and feeding the poor. Think –

- If you’re a dentist you help people smile.

- If you’re a teacher you help people grow.

- If you’re a financial planner you help people get freedom.

- If you’re a real estate agent you help people get shelter.

- If you’re a restaurant owner you help people get nourishment.

- If you’re a psychologist you help people get peace of mind.

So why not link the direct impact that your business makes to an additional impact to affect families in need. I call this, becoming a Business for Good.

- Become a Dentist for Good and everytime someone gets their teeth cleaned, you provided a regular dental check up for someone in India – $2 via https://www.b1g1.com/projectdetail/718

- Become a Teacher for Good and everytime someone completes your course, you provided teaching materials to an ethiopian nursery school – 3 cent via https://www.b1g1.com/projectdetail/483

- Become a Financial Planner for Good and everytime someone invests on your advice, you financial planner you help people get freedom.

- Become a Real Estate Agent for Good and everytime you sold a house, you provided shelter for an underprivileged person in India – 13c via https://www.b1g1.com/projectdetail/325

- Become a Restaurant for Good and everytime someone enjoys a meal with you, you gave seeds to nourish a child in Malawi – 1 cent via https://www.b1g1.com/projectdetail/322.

- Become a Psychologist for Good and every time someone completed a session with you, you provided blankets to insulate a child from winter in Moldova – 6 cents via https://www.b1g1.com/projectdetail/723.

You get the point…

I believe that business should be the driving force behind creating a better world, and becoming a Business for Good is how to make that impact.

[Watch] 6 min overview of the B1G1 Business for Good Platform

Cambodia, The Kingdom of Wonder.

Cambodia is one of the poorest and least developed countries in the world. The wounds that have been caused by decades of war, take a long time to heal. Today Cambodia is somewhat politically stable, but many people still lack some basic necessities for everyday life.

The lack of a working infrastructure and the poor economic situation of the country, only serves to highlight the growing problems. The mass-murder of nearly 2 million people by the Khmer Rouge (1/4 of the total population), mostly out of the educated elite, caused a huge mental and spiritual deprivation. Today 40% of the Khmer live below the poverty line.

Unfortunately these problems have a massive effect on the children of Cambodia. Every day is a struggle for survival. Cambodia’s infant mortality rate is 17 times higher than Germany’s.

In their young lives, they are endangered by Diarrhoea, Malaria, Dengue-Fever, HIV, malnutrition, child prostitution and human trafficking. Without access to medical attention and school education, the future of the children is wrapped in darkness.

That’s why we chose Cambodia as a country to give some of the 3M days of access to life changing help.

Here are some of the highlights of our Holiday for Good to Cambodia –

Happiest Kids Ever ❤️ We visited the villages yesterday where we’ve been supporting the building of water wells, filters, toilets & health education in rural Cambodia. Although the children seemed so happy with nothing, they really loved the gifts of toys, books & coloring pens. Thanks to B1G1.

Make An Impact Some of the mums, dads, brothers and sisters, who make up the billion people globally who live on about a dollar a day.

They’ve given us more (life lessons) than we’ve given them today. Thankyou

2 boys, both 10 One won ‘the human lottery’ by being born in the land of opportunity – Australia – the other didn’t. We don’t get to choose where we’re born, but we do get to choose how and why we live. “Live to give”.

Real World Education I wanted to show our kids (6 & 10) that they already live in Disney land, everyday. We wouldn’t let dogs live in the conditions these children call home, that’s why I believe together we can (and we must) end extreme global poverty for good.

Clean Drinking Water I believe that business should be the driving force behind creating a better world. That’s why at Inspire we give a days worth of access to help to families in need, for every dollar of tax saved.

So far we’ve given 3M days worth of access to life changing projects like clean drinking water. Today we went to the remote villages in Cambodia to see first hand the impact we’ve made.

A Bio-Sand Water Filter (pictured) lasts up to two decades or more and is able to provide for an entire family. One of the easiest ways to combat poverty and disease is to provide access to clean water sources.

Together we can end global poverty – https://b1g1.com/projectdetail/675

Life Changing Water What a privilege to meet some of the families impacted by the provision of water wells and bio sand water filters (pictured). You can hear the stats about the world water crises but hearing from the people affected by it, will change your life. You can change theirs by integrating giving into your business too, here is the link to the specific project shown here (and you’ll be amazed at how little it costs) – https://b1g1.com/projectdetail/675

Take a Holiday for Good.

Want to 10x Your Impact? Go and visit the projects you are supporting to see first hand the impact that you are making. Take the family. Take the kids. Take the team. Take your clients. Take your alliance partners. Damn, take your competitors! You might just come home as collaborators!.

But seriously, a Holiday for Good is life changing not just for the families in need, but for you.

I have a personal philosophy that business owners should take 8 – 12 weeks holiday per year and that one of those holidays be a Holiday for Good.

Imagine going to Ethiopia, Laos, Moldova, Morocco, Kenya, Lebanon for a once in a lifetime experience that you couldn’t any other way.

When I do my holiday planning each year – I set aside the 12 weeks of holidays first, then book in everything else around that – I plan for 4 types of holidays.

- Bucket List – Somewhere I’ve ALWAYS wanted to go.

- Chase the Sun – We love the sea, so somewhere by the beach.

- Business ReTREAT – A working holiday where my business partner (and our families) go to work ON our business while having some family time.

- Holiday for Good – at the beginning of each year to see first hand the impact we’ve made from a year of giving.

So where are you off to next?

Have More. Give More.

Now you might be asking, “how the hell do I afford to give, take all these holidays and not be in my business for 3 months of the year?!?”

The answer is simple. You get Cashed Up.

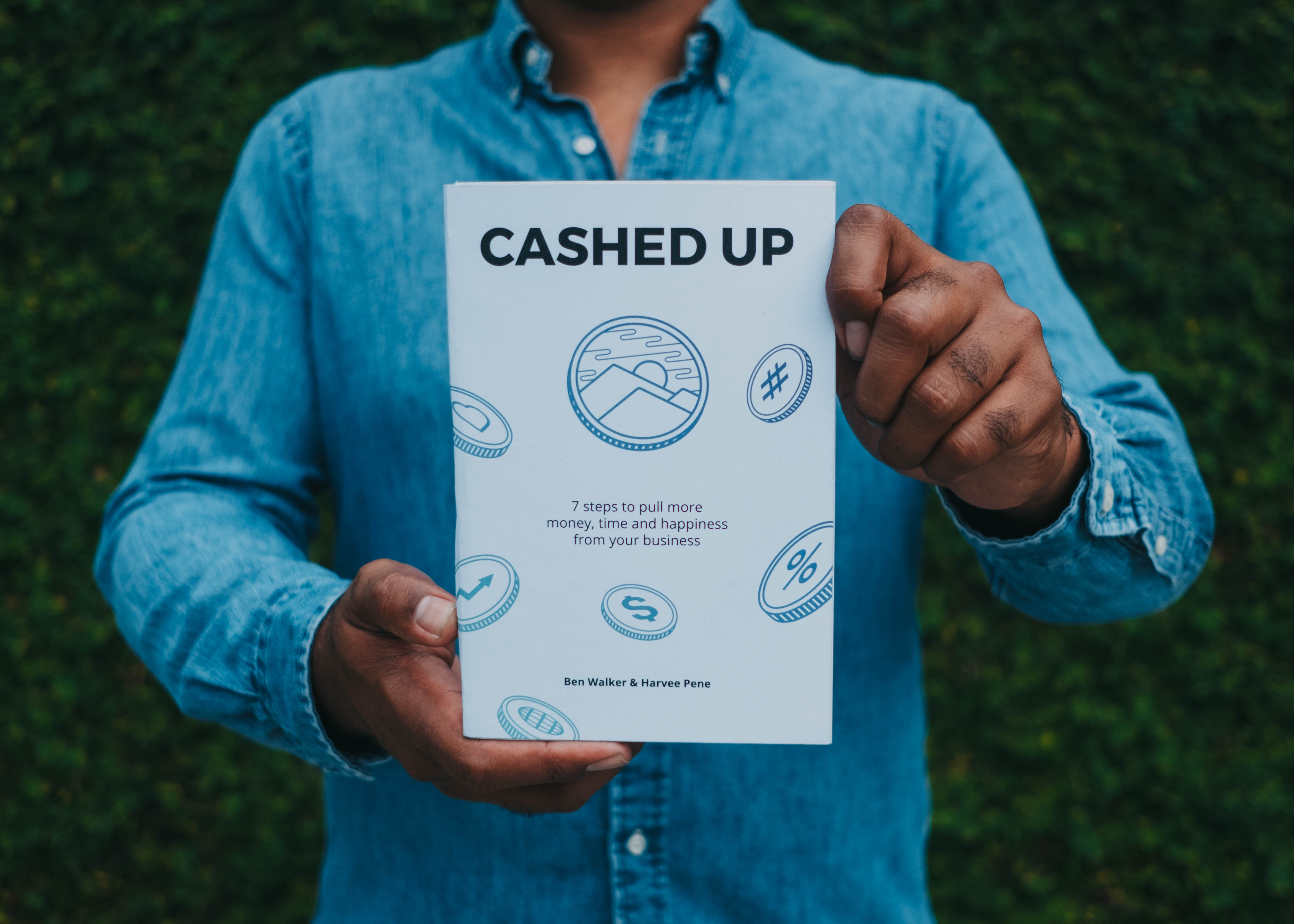

In working with thousands of business owners over 5 years we found that most were financially drowning, just keeping their head above water or seriously Cashed Up. Upon reviewing their numbers we found there 7 key mistakes that business owners were making that we’re keeping them Cash Poor. That’s when the Cashed Up Book & 7 Smart Financial Decisions were born.

If you’re in business and you want to pull more money, time and happiness from your business you need to start making smarter financial decisions.

The top 7 Smart Financial Decisions of a Cashed Up Business are –

- Cut Tax

- Capture Profit

- Control Cashflow

- Check Numbers

- Crank Biz Value

- Cover Assets

- Create Lifestyle

The Cashed Up Book is launching in March 2018 in partnership with Commonwealth Bank, Xero and Buy One Give One.

Tell Everyone.

I’d like to finish with a quote from a dear friend and mentor Glen Carlson (Co-Founder of Dent Global) who said –

“it’s not about how much you’re giving, it’s about how effectively you are engaging others to give as well.”

So once you’ve decided to make an impact by becoming a Business for Good, I recommend you tell everyone.

SHARE. ENGAGE. INSPIRE.

B1G1 lets you track every single impact you create in real time. You can easily share that with your team and clients via unique tools, such as interactive ‘widgets’ and maps.

Check out some examples of our Impacts –

Our Giving Impacts Widget

Our Giving Impacts Map

Becoming a Business for Good may just be one of the most important things you do this year. For your business, for your life and for the world.

Remember – Dream Big. Make an Impact. Remember Your Roots.

P.s. Stay Tuned for part two as my business partner Ben Walker returns from his Holiday for Good in Kenya

SAVING $8,000 A MONTH BY BUYING AN OFFICE (IN OUR SMSF)

6 Quick wins buying a business property in your family SMSF

I’ll start off by saying that as a serial entrepreneur, I was fairly “Anti-Super” for a very long time. That was until my best mate, business partner and tax wizard Ben Walker showed me how easy it was to become a SMSF Millionaire.

He’s an accountant, I’m not. So he’ll chime in every know and then during this blog with the technical bits.

Before we get started: this is not advice – personal or general – just what we’ve done, and sharing because people were asking!

For the busy reader, here are the 6 quick wins I experienced by buying our business premises in the family SMSF.

-

Did you know you can make voluntary contributions to superannuation to save thousands in tax?

Our family contributed about $100,000 to super to buy a commercial property and in so doing saved $32,000 in tax.

-

Did you know you can have 4 members in a Self Managed Super Fund?

This saved us thousands in retail super admin fees because we had literally 10 funds between the four of us.

-

Did you know you can pay for your life insurance premiums from super?

This put thousands a year back in our pocket as we switched our insurance premiums to come from the super fund instead.

-

Did you know you can have your SMSF buy your business premises and essentially become your own landlord?

This strategy saved us $8,000 a month in lease expenses and turned a common business expense into a family wealth stream.

-

Did you know we borrowed 75% LVR in our SMSF?

This meant we only put in around $150,000 cash plus a few expenses (from our super fund) to buy a $580,000 commercial property.

-

Did you know you can pay 0% tax on capital gains when a super fund is in ‘pension’ phase?

This could save us up to $136,300 in tax if our property doubles in value in the next 10 years.

That’s the quick summary. Now if you want to go into detail on these strategies, read on….

Paying Too Much Tax? Learn the 12 strategies that have proactively saved our business clients $3M+ in tax at the next 12 Tax Saving Strategies workshop coming up this month in BNE, SYD & MEL – www.inspireca.com/SaveTax

The little (coffee) shop of horrors…

Funny story, when we first launched Inspire CA 4 years ago, we also launched the Inspire Cafe. An accounting firm in the middle of a cafe, to break the mould on what a model accountant could look like. The idea was great, but the numbers didn’t really add up.

We were paying a GIGANTIC amount of rent each month for 250 square metres in Doggett st, Newstead.

12 months ago we managed to get out of our 7 year lease with 4 years to go (don’t ask how … ) and used that time to save up and buy our own office.

See, you can use your Self Managed Super Fund to purchase a Commercial Property and have your own business rent it off the SMSF as your business premises.

We bought a ‘renovators delight’ (aka complete dump) in the valley and after an extensive fitout, we’re aiming to move in in March 2018.

Best thing is, we’ll go from paying an eye watering amount of rent each month (to someone else) for 250 squares to paying our own super fund less than half of our previous rent for 160 squares, just 2 streets away. It works out to about a 7% return for the SMSF and we’ll pay ZERO tax on the capital gain when we sell it in 15 years.

That’s a win-win-win-win.

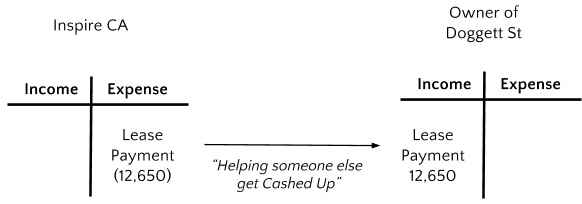

Crunching the Numbers

Saving almost half a million dollars in lease expenses

Right now, we’re in the shoes of our business – looking at the saving in rent.

Doggett St lease (250 square meters) – $11,500 plus GST / month

Ann St lease (160 square meters) – $4,000 plus GST / month

Monthly savings – $7,500 plus GST / month or $8,250

Annual savings – $90,000 plus GST / year or $99,000

Savings over 5 years – $450,000 plus GST or $495,000

Buying your business premises using your SMSF

So you’ve probably heard that you cannot use your SMSF to buy an apartment and have your family member rent it – that’s breaking the ‘sole purpose test’.

But did you know under certain conditions, you can use your SMSF to buy a commercial property and have your own business rent it from your SMSF. It’s amazing.

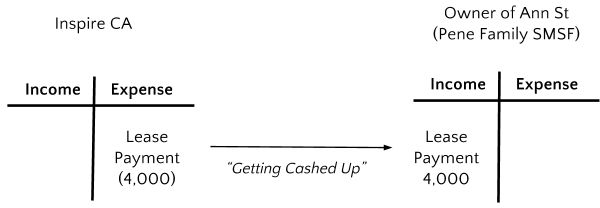

In our case not only were we paying a GIGANTIC amount of lease expense each month, but 100% of it went to the owner of the building.

Now the business pays a reasonable amount of lease expense each month and 100% stays in the family by being paid to the SMSF.

Put another way, by purchasing our business premises in our family SMSF we turned an business operations expense into a family wealth stream.

Before – Paying a commercial lease to someone else.

After – Buying our Business Premises in our Family SMSF.

[Watch] Buying Your Business Premises Using Your SMSF

What is 0% tax on a lot of money?

Around the Inspire office you can often hear Ben Walker saying “it’s impossible to get Cashed Up, if you’re giving half your profits to the tax man!” So let me tell you about the 2 x tax saving strategies we’re using in this deal.

1 – Additional Super Contributions – Saving us $32,000 a year in tax

One of the best ways you can reduce your tax legally is through making voluntary contributions to superannuation.

4 x members of the Pene Family Super fund contribute $25,000 each into super.

How much tax do we save?

$25,000 super contribution x 32% tax saving (47% tax rate outside of super minus 15% tax rate inside of super) = $8,000 tax savings each.

That’s a huge $32,000 per year tax saving for the 4 x members of the SMSF!

Woohoo, but that’s not the best part.

In the strategy corner with Ben Walker – Be careful to not exceed your ‘Contribution Cap’ for deductible superannuation contributions.

For the 2017 Financial Year (ending 30 June 2017) the Cap (or maximum you can put in, without additional tax) is based on your age.

If you’re 48 years or younger, the limit is $30,000 in the financial year.

If you’re 49 years or older, the limit is $35,000 in the financial year.

For the 2018 financial year (from 1 July 2017 onwards) both of these caps reduce to $25,000 regardless of age.

Going over the caps mean you pay an effective tax rate of 47% in tax. Ouch!

2 – Zero Tax in Pension – Paying 0% tax on $500,000 profit

Another killer tax saving strategy is that you can pay 0% tax on capital gains in a super fund if it’s in ‘pension mode’. How does it work?

We mentioned before that the tax rate in super is a flat rate of 15%. That’s how we saved 32% in tax (47% tax rate outside of super minus 15% tax rate inside of super) by making voluntary contributions into super.

What you may not know is that super funds have two tax rates. One for each phase it’s in –

15% tax when it’s in accumulation phase.

0% tax when it’s in pension phase and the member is over 60 years old.

What is the difference between pension phase & accumulation phase?

‘Accumulation phase’ is what we refer to when you’re working or running a business, and you’re actively accumulating a superannuation balance. Basically this is the phase you’re in, until you start taking a pension – then you switch to ‘Pension phase’.

‘Pension phase’ is when you start drawing down on the money in your superannuation. You can only do this once you’ve reached ‘preservation age’ (current 56 years old, and heading up). And pensions become tax free in most conditions once you’ve reached 60 years old!

Note: The following is a hypothetical assumptions (that we hope come true!)

The Pene Family Super Fund bought 915 Ann st for about $580,000 in 2018.

If in 10 years time we can sell it for $1.16M that will be a $580,000 capital gain or profit – aiming to double our money!

If we owned the property in my personal name I’d pay $136,300 tax.

$580,000 Capital Gain

Less $290,000 CGT Discount (50% is CGT free because we held it longer than 12 months)

Equals $290,000 Profit

Multiplied by 47% Tax Rate (because it’s in my own name, and I’m already a high income earner as a business owner)

Equals a whopping $136,300 tax payable.

Because we own the property in a Self Managed Super Fund, we’d pay $0 tax.

$590,000 Capital Gain

Multiplied by 0% Tax Rate on the most of the gain (because the members with the largest balances in the fund at that time will be in pension phase as 2 of its members reach 60+)

Equals a whopping $0 tax payable.

Have I got you excited yet? I sure am!

Check out the ‘BEFORE’ photos.

At 7% return it’s positive cashflow

I’m no property investment guru, but I bought my first property at 17. I’ve always worked on a simple ROI model that if I can get at least $100 of weekly rent for every $100K of Property Value, then it seemed like a good deal.

For example –

- A $500,000 Property, gets at least $500 / week rent.

- A $300,000 Property, gets at least $300 / week rent.

- A $180,000 Property, gets at least $180 / week rent.

That rule of thumb worked ok for me when investing in residential property but I was amazed to see how did it stack up in this commercial deal?

Ann St is about a $580,000 Property plus $100,000 for fitout and additional purchase costs.

So let’s call it $680,000 max to get it ready for rent.

And it gets $4,000 / month rent or just over $900 / week rent. Not bad. In all my years of investing I’ve struggled to find a deal like that.

Making 7% return by becoming our own landlord

$580,000 purchase price + $100,000 fitout = $680,000.

$4,000 / month x 12 months = $48,000 / year.

$48,000 rent / $680,000 Purchase Price = 7.06% return

Pay your Life Insurance premiums from Super – and get double tax benefits.

Life Insurance is money your family will receive in the event of you kicking the bucket.

Interestingly the premiums you pay for Life Insurance are not tax deductible, unless they’re paid from your superannuation.

Let’s say the premiums for your Life Insurance are $5,000 per year.

Option 1 (Without Tax Planning): Pay the $5,000 Life Insurance premium outside of super.

No tax deduction applies. If you’re on 47% tax rate you’d have to earn $9,434 before tax to then pay the tax and have $5,000 leftover to pay your Life Insurance Premiums.

Option 2 (With Tax Planning): Pay the $5,000 Life Insurance premium from your super fund.

First of all we need money into your super fund to pay the premium.

Business contributes $5,000 into Super.

This alone saves $2,350 tax, when compared to paying 47% tax in your own name.

Super fund pays 15% tax on $5,000 in super = $750 due.

Super fund pays $5,000 Life Insurance premium.

Super fund get 15% tax deduction for premium expense = $750 refund.

By paying your Life Insurance Premium from super, you’d save $2,350 in tax on the super contribution IN (when compared to paying tax in your own name) AND you’d receive a tax deduction for the $5,000 premium paid.

Any information and content on our website or social media property is general in nature only. It does not take into account the objectives, financial situation or needs of any particular person. So before acting on anything to do with your finances, you need to consider your financial situation and needs before making any decisions based on this information.

Benjamin Walker of Inspire SMSFS Pty Ltd (ASIC Authority 1243433) ABN 38 879 130 483 is an Authorised Representative of

Finance Wise Global Securities Pty Ltd ABN 60 146 708 045. Finance Wise Global Securities Pty Ltd holds Australian Financial

Services License No. 397877.

YEAR IN REVIEW 2017

We are numbers people and

WE BELIEVE THAT FAMILY IS NUMBER ONE

Our model is simple

Proactive Tax & Accounting that pays for itself in tax savings

then

Help to make the 7 Smart Financial Decisions of a Cashed UpTM Business.

Perfect for

Founders of 6 & 7 figure business owners

WHO ARE IN BUSINESS FOR A PURPOSE HIGHER THAN PROFIT

In TWENTY SEVENTEEN WE –

HIT $3M IN PROACTIVE TAX SAVINGS

FOR OUR SMALL BUSINESS CLIENTS.

That’s a whole lot of money back in the hands of the hard working families, that otherwise would have gone to the ATO. You don’t really think the tax-man deserves a tip do you?

WE GAVE 3 MILLION DAYS OF LIFE CHANGING HELP

TO FAMILIES IN NEED, IN 16 COUNTRIES.

(Food, Water, Health & Nutrition)

n Feb we launched the #GIVE1MDAYS campaign – a bold giving target to give one million days worth of access to water in 2017, in partnership with Global Giving Initiative B1G1 or Buy One Give One.

In the end we gave 3 million Days of access to not just water, but also food, health & nutrition services – a day of help for every dollar in tax saved.

We call it ‘Day for a Dollar’ – Inspired by how TOMS One for One initiative gives a pair of shoes for every shoe bought or how Zambrero feeds the hungry through ‘Plate 4 Plate’.

Why? As Accountants we love numbers, but when we found out that almost a billion people live on about a dollar a day, we knew we had to do something.

We believe that every business has the power to change lives by integrating giving into its everyday activities.

‘Day for a Dollar’ is a simple but powerful example of how together we can end global poverty, for good.

In Jan 2018 I’m hitting the ground in Kenya – and my business partner Harvee Pene is heading to Cambodia – to see first hand the impact we’re making thanks to your support of Inspire.

Wanna join us in the developing lands? Follow the Inspire CA – Life Changing Accountants for live project updates from the field.

WE STARTED A MOVEMENT FOR GOOD

WE INSPIRED 87 OTHER BUSINESSES TO GIVE 1,000,000 DAYS OF LIFE CHANGING HELP TO FAMILIES IN NEED.

After being nominated for Top 10 Global Business for Good at the Buy One Give One annual conference on the gold coast, Ben Walker was asked to share the magic and the mechanics behind our game changing #GIVE1MDAYS campaign.

At the end of the riveting TED style talk, the challenge was given to the audience. “I challenge you to pledge to Give 1,000,000 Days of life changing help to families in need?’ 87 Business Owners stood and said “YES!”.

That’s a huge 87,000,000 impacts pledged.

Since then the total B1G1 Giving Impact have reached record highs of 136,025,405 days and over $1,000,000 has been donated to fight global poverty in the developing lands.

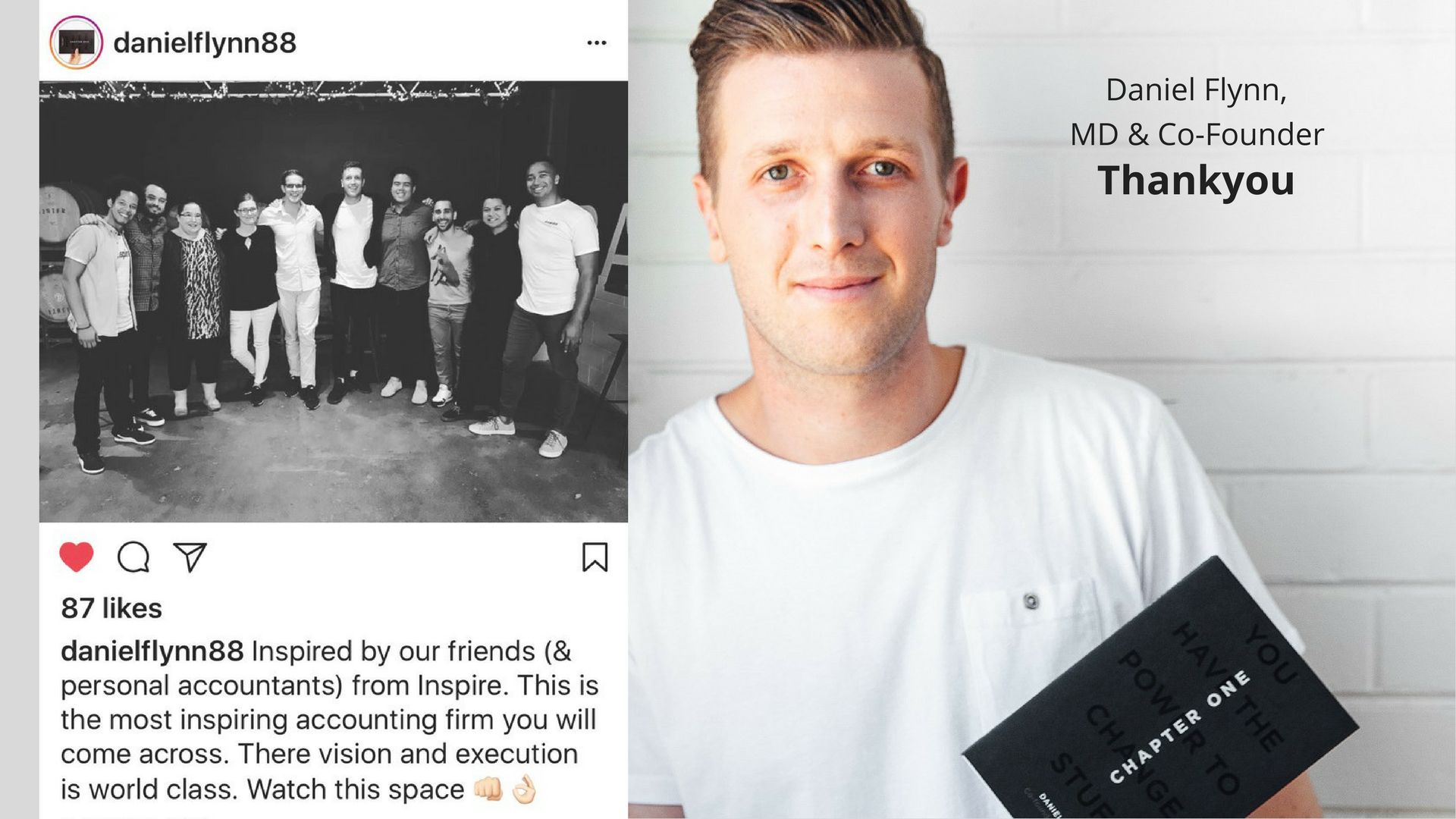

DANIEL FLYNN CAME ONBOARD WITH INSPIRE

THE FOUNDERS OF THANKYOU JOINED THE INSPIRE FAMILY

We are pretty proud to be able to welcome Daniel Flynn to the Inspire Family this year, along with the other founders of Thankyou. Thankyou has long been idols of ours, so you can imagine our excitement when Dan not only came to speak at one of our team retreats (weeks before speaking with Barack Obama), but when he said –

“Inspired by our friends (& personal accountants) from Inspire. This is the most inspiring accounting firm you will come across. There (sic) vision and execution is world class. Watch this space.”

WE REBRANDED

DROPPING THE CA – AND BECOMING JUST INSPIRE.

Remember that scene from the social network when facebook was called “THE Facebook” and Justin Timberlake said “drop the THE, just Facebook”.That’s what was going through our minds when we moved to just Inspire. It signalled the move from a focus on just tax (which is how we first started) into a broader focus into Helping Young Families Use their Small Business to get Cashed Up. Speaking of which ..

WE LAUNCHED CASHED UP

HELPING BUSINESS OWNERS MAKE 7 SMART FINANCIAL DECISIONS

In working with thousands of business owners over 5 years we found that most were financially drowning, just keeping their head above water or seriously Cashed Up. Upon reviewing their numbers we found there 7 key mistakes that business owners were making that we’re keeping them Cash Poor. That’s when the Cashed Up Book & 7 Smart Financial Decisions were born.

If you’re in business and you want to pull more money, time and happiness from your business you need to start making smarter financial decisions.

The top 7 Smart Financial Decisions of a Cashed Up Business are –

- Cut Tax

- Capture Profit

- Control Cashflow

- Check Numbers

- Crank Biz Value

- Cover Assets

- Create Lifestyle

The Cashed Up Book is launching in March 2018 in partnership with Commonwealth Bank, Xero and Buy One Give One.

WE DOUBLED THE TEAM

“THE TEAMWORK MAKES THE DREAM WORK”

In our mission to become Australia’s Most Impactful Accounting Firm we welcomed Chloe McKie, Regnier “Reggie” Alexander Guzman Silva, Ali Alajmi and Ethan Paraha-Cutts to the Inspire team of Life Changing Accountants.

AND WON A BUNCH OF AWARDS

Including B1G1 Top 10 Global Business of the Year, Anthill Online 30 under 30 Awards (Honourable Mention), Dent Global Partnership Award (pictured) and probably the most significant of them all.

Anthill Top 100 Companies in Australia 2016 & 2017 – 2nd year in a row. These are the coveted cool company awards and coming from an industry where most accountants are considered ‘boring’ we thought this was pretty cool.

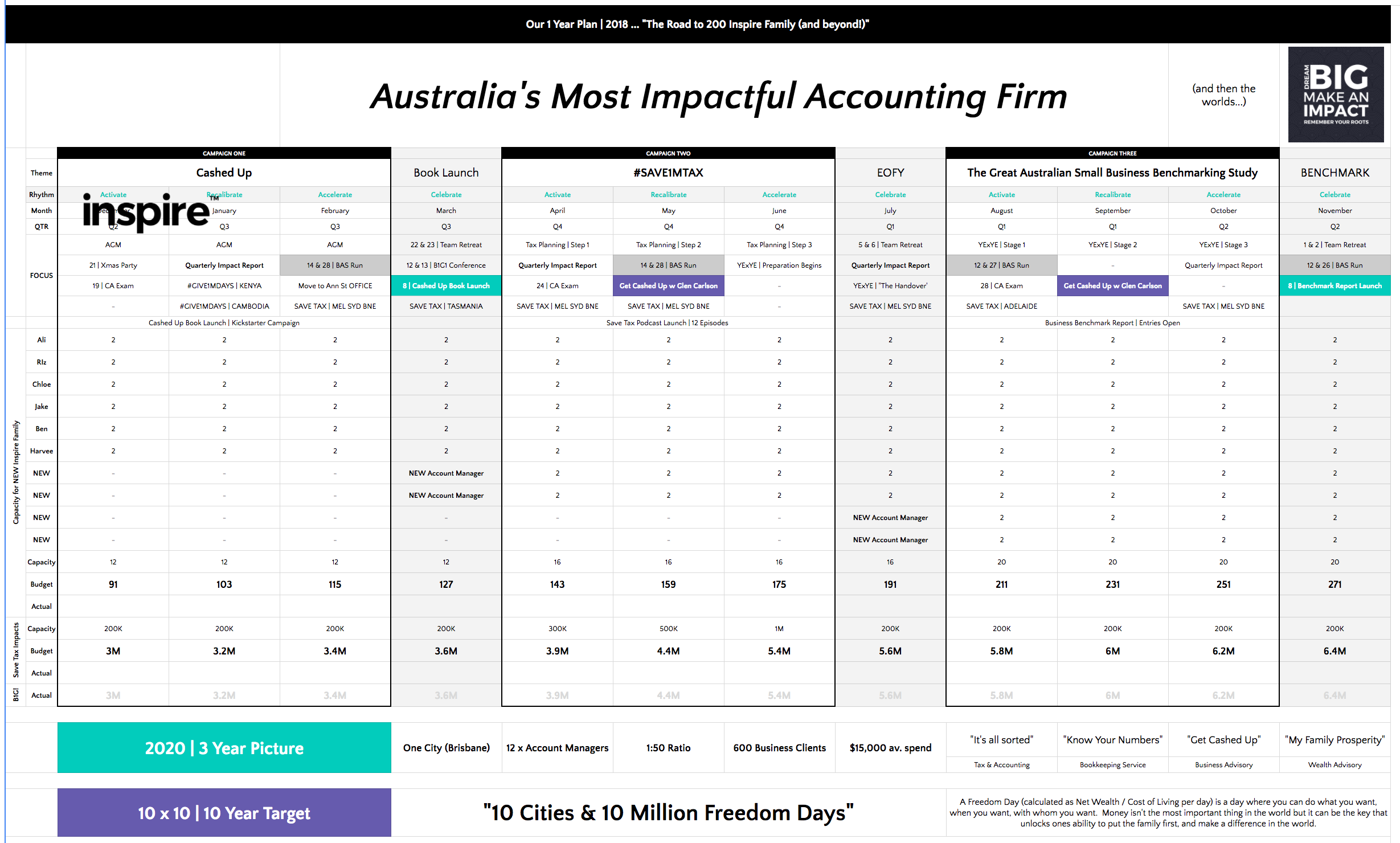

WE SOFT LAUNCHED IN SYDNEY & MELBOURNE

STARTING OUR 10 YEAR 10 CITY VISION

Off the back of our uber-popular Save Tax Workshops (to share the 12 strategies behind how we saved our clients $3M in tax) we set up our satellite offices in Sydney and Melbourne in partnership with WeWork.

Currently we have about 20% of our clients in Sydney and Melbourne.

This was the first step in realising our “10 Cities & 10 million Freedom Days” vision.

And what’s a Freedom Day you ask?

A Freedom Day (calculated as Net Wealth / Cost of Living per day) is a day where you can do what you want, when you want, with whom you want.

Money isn’t the most important thing in the world but it can be the key that unlocks one’s ability to put the family first, and make a difference in the world.

Every piece of advice we give you will not only help you get Cashed Up, but also build your Freedom Days.

WE BROUGHT AN OFFICE

USING OUR SMSF TO BUY IN FORTITUDE VALLEY

Funny story, when we first launched Inspire CA 4 years ago, we also launched the Inspire Cafe. An accounting firm in the middle of a cafe, to break the mould on what a modern accountant could look like. The idea was great, but the numbers didn’t really add up.

We were paying – wait for it – $11,500 plus GST a month for 250 square metres in Doggett st, Newstead.

12 months ago we managed to get out of our 7 year lease with 4 years to go (don’t ask how … ) and used that time to save up and buy our own office.

See, you can use your Self Managed Super Fund to purchase a Commercial Property and have your own business rent it off the SMSF as your business premises.

We bought a ‘renovators delight’ (aka complete dump) in the valley and after an extensive fitout, we’re aiming to move in in March 2018.

Best thing is, we’ll go from paying an eye watering $11,500 plus GST per month (to someone else) for 250 squares to paying our own super fund $4,000 plus GST a month for 160 squares, just 2 streets away. That’s a great 7% return for the SMSF and we’ll pay ZERO tax on the capital gain when we sell it in 15 years.

That’s a win-win-win-win.

WHERE TO FROM HERE

WHAT’S THE PLAN IN 2018?

- We’re heading to Cambodia and Kenya to visit some of the projects we’ve supported through our Day for a Dollar Campaign.

- We’re launching the Cashed Up book in March.

- We’re running the Cashed Up workshop in May and September in Sydney.

- We’re hiring 4 x more Life Changing Accountants (we’d love an intro if you know any inspirational accountants)

- We’re on track to save another $3M in Tax for small business (and therefore give another 3M days of life changing help to families in need)

- We’re running our Save Tax Workshops in BNE, SYD & MEL every 2nd month and are even running a few sessions in Tasmania and The Barossa Valley (Tax Deductible Holiday anyone??)

- We’re trying to get Jeff ‘The Hornet” Horn on board as a client.

- We’ll continue to work towards becoming Australia’s Most Impactful Accounting Firm.

Thanks for all your support and remember:

Dream Big. Make an Impact. Remember Your Roots.

Ben Walker & Harvee Pene

Co-Founders of Inspire

Australia’s Most Impactful Accounting Firm

WE DID IT | $3M in proactive Tax Savings & 3M days of help to families in need across 16 countries.

With every dollar of tax we proactively save a small business, Inspire will help a person in need for a day. Day for a Dollar

As of dec 2017, we’ve given 3 million days of access to life-changing food, water, hygiene and sanitation services, thanks to our partnership with Buy1Give1

Why? We love numbers, but when we found out that almost a billion people live on about a dollar a day, we knew we had to do something.

We believe that every business has the power to change lives by integrating giving into its everyday activities.

Day for a Dollar is a simple but powerful example of how together we can end global poverty, for good.

In January Ben Walker is hitting the ground in Kenya – and Harvee Pene is heading to Cambodia – to see first hand the impact we’re making to families in need.

Follow the Inspire – Life Changing Accountants Facebook page for live project updates from the field.